Latest Advances in Occupancy Sensor Detection Methods

The occupancy sensors market continues to expand rapidly in 2025, fueled by rising demand for energy efficiency and advanced automation. The global occupancy sensor market reached $2.6 billion in 2024 and is projected to hit $6.1 billion by 2031. This growth results from strong government regulations, new smart building projects, and AI-powered innovations.

| Metric/Aspect | Value/Projection |

|---|---|

| Occupancy sensors market size | $2.6 billion in 2024 |

| Projected growth | 12.3% CAGR to $6.1 billion by 2031 |

| Unit shipments | Over 100 million units in 2025 |

| Leading region | North America |

Smart occupancy sensors now leverage AI, IoT, and multi-sensor detection, driving new trends. Improved detection methods deliver greater energy efficiency, seamless automation, and enhanced user experience across smart environments.

Occupancy Sensors: Detection Methods

Modern occupancy sensors use several detection methods to identify presence and movement in spaces. The most common types include PIR sensors, ultrasonic sensors, microwave sensors, and dual-technology sensors. Each method offers unique strengths for applications such as occupancy sensor light switches, building occupancy sensors, and non-residential occupancy sensors. Recent advancements have improved accuracy, reliability, and adaptability, making these sensors essential in lighting technology and smart environments.

PIR Sensors

Passive Infrared (PIR) sensors detect changes in infrared radiation caused by human motion. These sensors remain popular in occupancy sensor light switches and non-residential occupancy sensors due to their low power use and cost-effectiveness. Recent improvements include the use of resistance microbolometer MOEMS-based sensors, which extend detection range and sensitivity. These upgrades allow PIR sensors to detect slow temperature changes and even identify developing electrical faults. Enhanced wafer-level packaging in MEMS and CMOS foundries has also increased performance, making PIR sensors more reliable for lighting technology and energy management.

Ultrasonic Sensors

Ultrasonic sensors emit high-frequency sound waves and measure the reflection to detect motion. These sensors excel in detecting minor movements, making them ideal for occupancy sensor light switches in offices and classrooms. Research shows that when combined with neural networks, ultrasonic sensors achieve up to 99% accuracy in object detection. The table below compares different ultrasonic sensor types:

| Sensor Type | Accuracy | Resolution | Measurement Range | Power Consumption | Advantages | Limitations |

|---|---|---|---|---|---|---|

| Piezoelectric (PZT) | ±1% | 1 mm | Up to 10 meters | Low (<10 mA) | Inexpensive, robust, simple design | Limited accuracy at long ranges, temperature-dependent |

| Ceramic Transducer | ±2% | 1 mm | Up to 5 meters | Low (<10 mA) | Compact, easy to manufacture | Limited accuracy at long ranges, temperature-dependent |

| Capacitive Transducer | ±0.5% | 0.1 mm | Up to 1 meter | Very low (<5 mA) | High accuracy, compact design | Limited range, sensitive to temperature/humidity |

| MEMS-Based Transducer | ±0.2% | 0.01 mm | Up to 1 meter | Very low (<5 mA) | High accuracy, compact, suitable for small ranges | Expensive, complex manufacturing |

| LIDAR-Based Transducer | ±0.2% | 0.01 mm | Up to 10 meters | High (>100 mA) | High accuracy, long range, robust | Expensive, large size, complex design |

Ultrasonic sensors outperform infrared sensors in dusty or dirty environments, making them a top choice for non-residential occupancy sensors.

Microwave Sensors

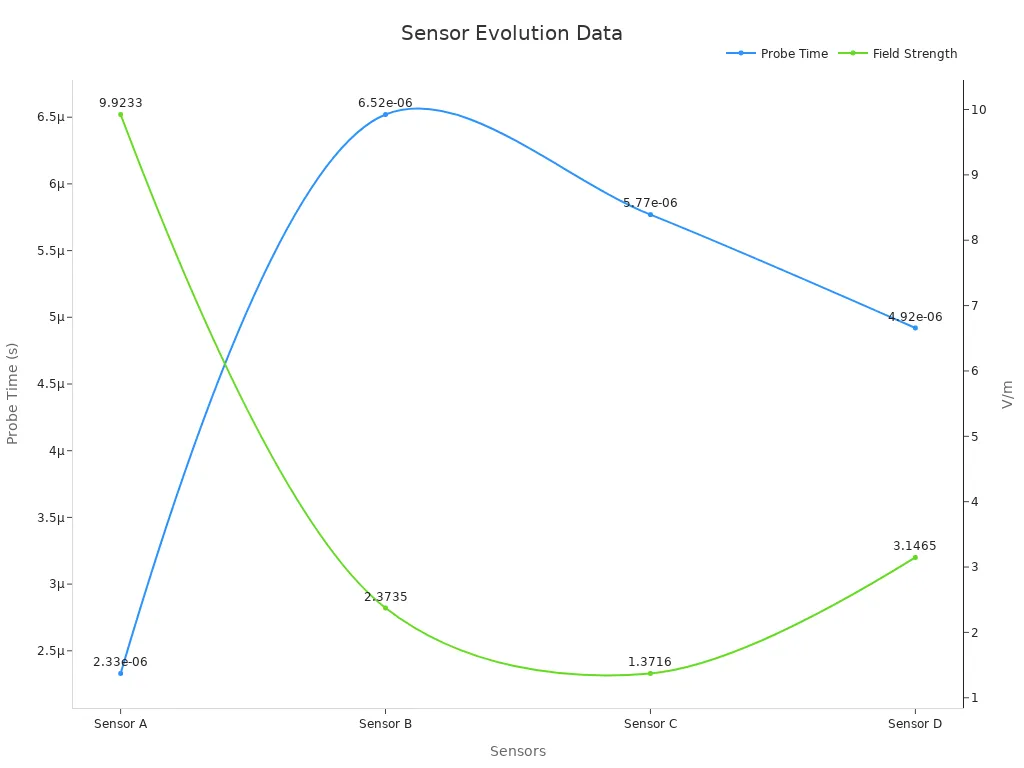

Microwave sensors use electromagnetic waves to detect motion and presence. These sensors penetrate walls and obstacles, providing reliable detection for non-residential occupancy sensors and occupancy sensor light switches in challenging environments. Recent studies show that sensor placement affects detection speed and electric field strength. Sensors closer to the target detect signals faster and with higher precision. The chart below illustrates how probe time and electric field strength vary across different sensor placements:

Machine learning integration has further improved microwave sensor accuracy, making them more effective for lighting technology and security applications.

Dual-Technology

Dual-technology sensors combine two detection methods, such as PIR and ultrasonic or microwave, to enhance reliability. These sensors reduce false positives and negatives by cross-verifying signals. Technical reports highlight that dual-mode sensors, like those integrating capacitive sensing with triboelectric nanogenerators, achieve higher sensitivity and recognition accuracy. Deep learning algorithms further boost performance, allowing non-residential occupancy sensors and occupancy sensor light switches to adapt to complex environments. Dual-technology sensors now play a vital role in smart buildings, where robust detection ensures efficient energy use and occupant comfort.

Note: A 2025 study using a regularized Bayesian Neural Network on office building data achieved 96% to 99% accuracy, outperforming traditional algorithms. This result demonstrates the impact of advanced detection methods on building occupancy sensors and energy savings.

Trends for 2025

The occupancy sensors market continues to evolve rapidly in 2025. New trends shape the future of smart building technologies, driven by advancements in AI, IoT, and sensor fusion. These innovations improve energy efficiency, security, and user comfort in smart homes and commercial spaces. The following sections highlight the most significant trends influencing the occupancy sensor market.

AI and Machine Learning

AI and machine learning have transformed occupancy sensors. These technologies allow sensors to analyze real-time occupancy data and make decisions instantly. AI-powered sensors adjust lighting and HVAC systems based on room usage, which saves energy and increases comfort. Machine learning models predict occupant behavior, improving the accuracy of smart building solutions.

AI enables sensors to detect patterns, identify anomalies, and adapt to changing environments.

Machine learning helps sensors forecast equipment failures, supporting predictive maintenance.

Real-world examples, such as The Edge in Amsterdam and Microsoft Redmond Campus, show how AI integration with IoT leads to efficient energy management and smart automation.

AI-driven systems also enhance security by monitoring occupancy and alerting staff to unusual activity.

Note: Machine learning models for occupancy prediction improve building performance by forecasting occupant behavior. This leads to better energy efficiency, indoor air quality, and thermal comfort.

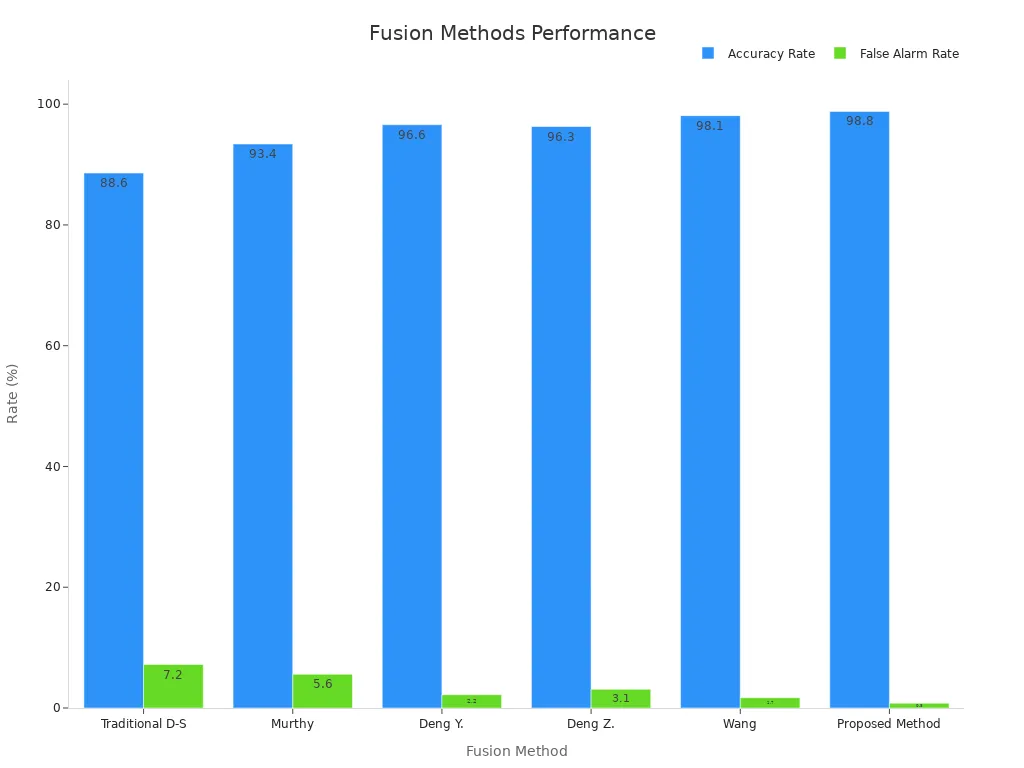

Multi-Sensor Fusion

Multi-sensor fusion combines data from different types of sensors, such as infrared, radar, and cameras. This approach increases detection accuracy and reduces false alarms in smart buildings. Researchers have developed advanced fusion algorithms that outperform traditional single-sensor methods, especially in challenging environments like low light or interference.

Fusion methods, such as radar-camera and vision-radar integration, achieve higher accuracy rates and lower false alarm rates.

Multi-sensor fusion improves detection in harsh weather, poor lighting, and complex spaces.

Industrial applications benefit from fusion by achieving over 97% accuracy in action recognition and defect detection.

| Fusion Method | Accuracy Rate | False Alarm Rate |

|---|---|---|

| Traditional D-S | 88.6% | 7.2% |

| Murthy | 93.4% | 5.6% |

| Deng Y. | 96.6% | 2.2% |

| Deng Z. | 96.3% | 3.1% |

| Wang | 98.1% | 1.7% |

| Proposed Method | 98.8% | 0.8% |

Multi-sensor fusion supports the integration with IoT, making occupancy sensors more reliable for smart building technologies.

Edge Computing

Edge computing processes sensor data locally, reducing the need to send information to the cloud. This approach lowers latency and improves privacy, which is essential for real-time occupancy data applications. Edge AI enables sensors to analyze data instantly, supporting fast responses in smart environments.

Edge computing allows occupancy sensors to operate even during cloud outages.

In manufacturing, edge AI reduces maintenance costs and improves equipment effectiveness.

Healthcare uses edge devices for patient monitoring, providing immediate feedback.

Smart city traffic systems use edge computing to adapt in real time, reducing congestion and improving emergency response.

A multimodal wearable sensor patch, for example, uses edge computing on a smartphone to analyze vital signs in real time. This system shows how edge computing enables quick feedback and efficient processing with minimal hardware.

Wireless and Wired Solutions

Both wireless and wired occupancy sensors play important roles in the occupancy sensors market. Wireless sensors offer easy installation and scalability, making them ideal for smart home integration and large commercial spaces. Wired sensors provide high reliability and security, which are important for critical smart building solutions.

| Performance Aspect | Wired Occupancy Sensor Solutions | Wireless Occupancy Sensor Solutions |

|---|---|---|

| Reliability | High reliability; resistant to interference; fewer consumables | Lower reliability; more susceptible to interference and disruption |

| Installation | Higher upfront installation cost; requires cabling | Easier and faster installation; lower initial cost |

| Maintenance | Low maintenance; fewer consumables like batteries | Requires ongoing maintenance; battery replacements needed |

| Scalability | Less scalable; adding sensors/zones costly | Highly scalable; sensors can be added/removed easily |

| Security | More secure; tamper detection possible; less downtime | Less secure; more vulnerable to disruptions |

| Cost | Higher upfront cost; lower recurring maintenance costs | Lower upfront cost; potentially higher maintenance costs |

Wireless sensors are practical for workplaces and smart homes due to their flexibility and quick deployment. Battery life and maintenance remain important considerations. Wired sensors, while more secure and reliable, require more complex installation. Organizations often choose a mix of both to balance scalability, cost, and security.

Tip: When planning smart building technologies, consider the specific needs of the space. Wireless solutions offer flexibility for expansion, while wired systems provide stability for critical operations.

Market Growth and Innovation Trends

The occupancy sensors market shows steady growth, driven by energy efficiency, smart home integration, and government incentives. North America leads the market, with Europe and Asia-Pacific showing strong potential. Innovation trends include wireless connectivity, real-time data transmission, and miniaturization. The table below summarizes key market drivers and trends:

| Aspect | Details |

|---|---|

| Market Drivers | Aging population, healthcare cost pressures, technological advancements (IoT, AI integration) |

| Key Regions | North America (dominant), Europe, Asia-Pacific (fastest growth) |

| Product Types | Pressure sensors, Infrared sensors, Ultrasonic sensors |

| Innovation Trends | Wireless connectivity, real-time data transmission, data analytics, miniaturization |

| Market Challenges | High initial costs, data privacy concerns, interoperability, user training |

| Growth Catalysts | Government initiatives, telehealth adoption, advanced sensor technology |

| Leading Players | Tunstall, Hill-Rom Holdings, STANLEY Healthcare, Arjo, others |

| Forecast Period | 2025-2033, with continued expansion driven by tech advances and demographic trends |

| Technological Focus | Integration with IoT and AI, cloud-based data management, wireless sensor networks |

Smart home integration and the adoption of smart building technologies continue to drive demand for advanced occupancy sensors. The occupancy sensor market remains moderately concentrated, with innovation-focused companies leading the way. As smart environments become more common, the integration of IoT and AI will further enhance the capabilities of occupancy sensors.

Applications

Smart Homes

Smart homes rely on non-residential occupancy sensors to automate daily routines and improve energy efficiency. These sensors control lighting technology, HVAC systems, and security features through home automation systems. Market research shows that occupancy sensor light switches help homeowners reduce lighting costs by 30–50%. Home automation systems use non-residential occupancy sensors to adjust temperature and lighting based on room usage, which leads to significant energy savings. The global market for smart home occupancy sensors reached USD 2.75 billion in 2024 and is expected to grow to USD 5.20 billion by 2030. This growth reflects the demand for energy-efficient solutions and sustainability practices. AI-driven sensors and IoT connectivity allow smart homes to adapt to occupant behavior, supporting green building goals and energy conservation.

Commercial Spaces

Commercial spaces such as offices, schools, and retail stores benefit from non-residential occupancy sensors in several ways. These sensors provide real-time data for lighting technology and HVAC systems, which improves energy management and reduces operational costs. Studies show that occupancy sensor light switches and advanced detection systems can cut energy usage by up to 50% in commercial buildings. Researchers have found that combining multiple sensor types, such as door-centric and camera-based systems, increases detection accuracy and reliability. Fisheye cameras, for example, offer better occupancy estimation and more energy savings than CO2 sensors. Non-residential occupancy sensors also support space management and security, making them essential for smart building technologies and sustainability.

Smart Cities

Smart cities use non-residential occupancy sensors to enhance urban infrastructure and promote sustainability. These sensors collect real-time data for adaptive traffic control, energy management, and public safety. Urban planners use occupancy sensor light switches and other sensor networks to optimize traffic signals, reduce congestion, and improve building energy efficiency. Energy management systems in smart buildings rely on non-residential occupancy sensors to track usage patterns and enable demand response. Cities like Bengaluru have adopted sensor-based traffic management to support sustainability and energy conservation. Non-residential occupancy sensors play a key role in green building initiatives and the broader push for sustainable urban development.

Challenges

Privacy

Occupancy sensors often collect sensitive data. Privacy concerns remain a top challenge, especially with camera-based and thermal imaging sensors. These devices can capture images or personal information, raising ethical and security questions in workplaces and public spaces. Many organizations now seek non-intrusive, anonymized sensor technologies to protect user privacy.

Camera-based sensors may invade employee privacy by capturing images.

Risks include exposure of personally identifiable information, such as badge data, which cybercriminals could exploit.

Sensor-free analytics, like Wi-Fi-based solutions, avoid image capture and offer real-time insights without extra hardware.

Best practices include using platforms with adjustable privacy settings, maintaining transparency with users, and employing cybersecurity measures.

A scientific review highlights that no current system fully resolves privacy issues. Computer vision methods, while accurate, increase privacy risks. Organizations must balance data accuracy with privacy protection when choosing occupancy sensors.

Integration

Integrating occupancy sensors with existing building systems presents technical and operational challenges. Many smart buildings require sensors to work seamlessly with booking, HVAC, and lighting controls. However, differences in protocols and platforms can create barriers.

Accurate presence detection depends on sensor selection and placement.

Interoperability issues arise when connecting sensors to legacy systems.

Uncertainty in virtual sensing and sensor fusion requires thorough analysis to ensure robust performance.

The literature notes a gap in detailed documentation on integration challenges. While sensor applications are well documented, specific integration difficulties remain underexplored. This gap highlights the need for more research and standardized solutions.

Installation

Installation remains a significant barrier to widespread adoption. High upfront costs, complex wiring, and maintenance requirements can slow deployment, especially in developing regions.

| Challenge | Impact |

|---|---|

| High installation costs | Limits adoption in cost-sensitive markets |

| Maintenance needs | Increases operational expenses |

| Limited coverage | Reduces effectiveness in large spaces |

| Lack of awareness | Slows adoption and market growth |

Organizations often weigh the benefits of energy savings against these challenges. Regional differences also affect adoption rates, with developed economies moving faster than developing markets. Clear communication about benefits and simplified installation processes can help overcome these barriers.

Future Outlook

Emerging Research

Researchers continue to push the boundaries of occupancy sensors market innovation. New studies explore advanced machine learning models, such as Transformer-based algorithms, to predict building occupancy with greater accuracy. These models use features like time of day and spatial data from cell phones. They help predictive HVAC systems anticipate occupancy, which leads to better energy management and improved comfort. Some research combines data from PIR sensors and smart meters using deep learning. In one university office, this approach improved detection accuracy by 26.8% compared to older methods.

Scientists also investigate communication-as-sensing technologies. WiFi and Bluetooth Low Energy (BLE) now detect occupant presence and movement without direct contact. These methods offer high accuracy and low power use. They expand the range of sensor modalities in the occupancy sensors market. Reviews highlight the role of IoT and hybrid algorithms in collecting better data and making more accurate predictions. These advances support green building strategies and help achieve global sustainability goals.

Market Impact

The occupancy sensors market shows strong growth and transformation. Forecasts predict a compound annual growth rate of 14.1% from 2025 to 2032. This expansion comes from stricter energy efficiency regulations, new smart building technologies, and a focus on sustainability. Companies like Signify, Schneider Electric, and Honeywell lead the way with innovative products.

Occupancy sensors now play a key role in energy management. They enable intelligent control of lighting and HVAC systems based on real-time data. This reduces energy use and supports sustainability in commercial and residential buildings. Regional trends show high adoption in North America, Europe, and Asia-Pacific. Urbanization and local policies drive further growth. The future of the occupancy sensors market will center on smarter, more adaptive systems that help meet global sustainability goals and support the green building movement.

New detection methods and trends drive the rapid growth of occupancy sensors. These advances deliver strong energy savings and better user experiences.

In real buildings, occupancy sensors can cut energy use by over 50% and support space efficiency, security, and behavior change.

Dual-technology sensors reduce false triggers and boost energy savings in homes and offices.Smart sensor data helps spot energy waste early and supports better decisions. The future will see occupancy sensors play a bigger role in energy efficiency and smart environments.

FAQ

What is the main benefit of using occupancy sensors in buildings?

Occupancy sensors help reduce energy waste. They turn off lights and adjust heating or cooling when rooms are empty. This saves money and supports sustainability goals.

How do dual-technology sensors improve detection accuracy?

Dual-technology sensors use two methods, such as PIR and ultrasonic. They confirm movement with both types. This reduces false alarms and increases reliability in busy or complex spaces.

Are wireless occupancy sensors secure?

Wireless sensors use encryption and secure protocols. They protect data from most threats. However, wired sensors offer higher security for critical areas.

Can occupancy sensors work in all lighting conditions?

Most modern sensors detect movement in both bright and dark rooms. Technologies like microwave and ultrasonic do not rely on visible light, so they work well at night or in windowless spaces.

What maintenance do occupancy sensors require?

Most sensors need little maintenance. Users should check batteries in wireless models and keep sensor surfaces clean. Regular testing ensures proper function and long-term reliability.

The Key Role of Electronic Components in IoT DevicesUTMEL01 September 20234513

The Key Role of Electronic Components in IoT DevicesUTMEL01 September 20234513The article discusses the pivotal role of electronic components in Internet of Things (IoT) devices. IoT devices work by capturing real-world data using sensors, processing it through a microcontroller, and then sending it to the cloud for further analysis.

Read More How to Identify the Perfect Proximity Sensor for Your ApplicationUTMEL19 July 2025427

How to Identify the Perfect Proximity Sensor for Your ApplicationUTMEL19 July 2025427Find the best proximity sensors for your project by evaluating material, sensing range, environment, and system needs to ensure optimal performance and reliability.

Read More Trusted Vibration Sensors for Homeowners and Industry ProfessionalsUTMEL17 July 2025371

Trusted Vibration Sensors for Homeowners and Industry ProfessionalsUTMEL17 July 2025371Compare top vibration sensors for home and industrial use. Find trusted options for security, predictive maintenance, and equipment protection.

Read More Wiring and Mounting Photoelectric Sensors in 2025UTMEL15 July 2025422

Wiring and Mounting Photoelectric Sensors in 2025UTMEL15 July 2025422Wire and mount photoelectric sensors in 2025 with step-by-step safety, wiring, and alignment tips for reliable installation and optimal sensor performance.

Read More Essential Tips for Picking the Best Gas SensorUTMEL15 July 20251053

Essential Tips for Picking the Best Gas SensorUTMEL15 July 20251053Find out how to select gas sensors by matching target gases, environment, and compliance needs for reliable and accurate gas detection in any setting.

Read More

Subscribe to Utmel !