Microcontroller (MCU) Market Analysis

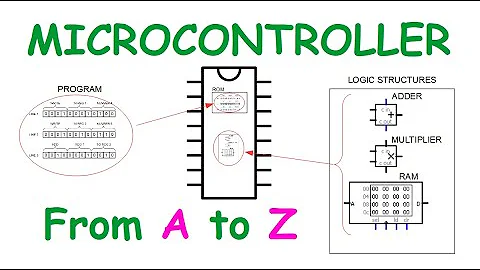

What is a microcontroller and how a microcontroller works

Catalog |

I. MCU in Detail: Industry Overview

MCU Introduction: MCU (MicrocontrollerUnit), also known as a microcontroller. Microcontrollers reduce the frequency and specifications of the CPU and integrate peripheral interfaces such as memory, timer, USB, A/D converter, UART, PLC, DMA, and even LCD driver circuits on a single chip to form a chip-level computer. Microcontrollers realize the function of terminal control and have the advantages of high performance, low power consumption, programmability, and flexibility. MCU is generally divided into 4-bit, 8-bit, 16-bit, 32-bit, and 64-bit.

Internal functional components: MCU internal functional components are mainly CPU, memory (program memory and data memory), I/O ports, serial ports, timer, interrupt system, special function registers, and some other auxiliary functional components such as clock oscillator, bus controller, and power supply, etc. In addition, many enhanced microcontrollers also integrate A/D, D/A, PWM, PCA, WDT, and other functional components, as well as SPI, I2C, ISP, and other data transfer interface methods, which make the microcontroller more characteristic and have more market application prospects.

Signal chain: In MCU applications, various analog or physical quantities in the physical world are converted into electrical signals by sensors, amplified by signal conditioning and then amplified by amplifiers, and converted into digital signals by ADCs, processed by MCUs or CPU s or DSPs, and reduced to analog signals by DACs, and finally output by power drivers.

MCU Classification

According to the number of data bits processed: 4-bit, 8-bit, 16-bit, 32-bit, and 64-bit.

According to the instruction structure: CISC (Complex Instruction Set Computer), RISC (Reduced Instruction Set Computer).

According to memory architecture: Harvard architecture and von Neumann architecture.

According to the application: general-purpose microcontrollers and dedicated microcontrollers.

MCU Market Overview

In the market, 32-bit MCU accounts for 54%, 8-bit accounts for 43%; MCU with RISC instruction set accounts for 76%, MCU with CISC instruction set accounts for 24%; general-purpose MCU dominates, accounting for 73%; MCU core type in the market is dominated by ARM Cortex, 8051 and RISC-V, accounting for 52%, 22% and 2% respectively.

II. Microcontroller industry chain analysis

Industry chain upstream situation

OEMs compete oligopolistically, and upstream bargaining power is strong. The upstream of the MCU industry chain can be divided into raw material suppliers and foundries (cooperating with midstream Fabless manufacturers). The raw materials are mainly wafers and core authorizations from ARM; foundries mainly include TSMC, GlobalFoundries, UMC, SMIC, Hua Hong Semiconductor, etc.

In 2019, the market share of TSMC, Grosvenor, UMC, and SMIC is over 90%, with TSMC's market share reaching 58.6%. Due to the irreplaceable nature of raw materials and the high concentration of foundry manufacturers, upstream manufacturers have strong bargaining power.

MCU industry competition in a brief

The industry is highly concentrated

Global MCU manufacturers are Renesas Electronics (Japan), NXP (Netherlands), Infineon (Germany), Microchip Technology (US), STMicroelectronics, etc. The market share of TOP7 head companies is over 80%.

Chinese MCU is catching up and gradually expanding its market share: domestic MCU chip makers have strong competitiveness in the low-end and mid-range markets. Zhaoyi Innovation, UW Semiconductors, Zhongying Electronics, Neusoft Carrier Wave, Beijing Junzheng, China Taiwan companies New Tang Technology, Polar Ocean Semiconductor, and other market share is steadily increasing.

Manufacturers such as STMicroelectronics, Renesas Electronics, Texas Instruments, Microchip, and Infineon adopt the IDM model, integrating chip design, chip manufacturing, chip packaging, testing, etc. Manufacturers such as NXP and most mainland manufacturers adopt the Fabless model and are only responsible for chip design and sales. Taiwan companies such as Holtek, Song-Han, and New Tang, as well as mainland China manufacturers such as Silan Micro and UW Semiconductors use the IDM model.

Downstream and end-use applications

MCU application areas: 2019 global MCU downstream applications are mainly distributed in four major areas: automotive electronics (33%), industrial control/medical (25%), computer (23%), and consumer electronics (11%). Specifically in China, MCU market sales in 2019 are concentrated in consumer electronics (26%) and computer networks (19%), while the proportion of MCU in automotive electronics (16%) and industrial control (11%) is significantly lower than the global level, and MCU applications in China are still mainly concentrated in home appliances and other categories.

III. MCU Growth Drivers

(1) Internet of Things

The number of global IoT devices is 9.1 billion in 2018, with a CAGR of 20.9% from 2010 to 2018, and is expected to reach 25.2 billion devices in 2025. The overall scale of IoT in China is growing year by year, the overall scale of IoT in China is 750 billion yuan in 2015, and is expected to reach 1830 billion yuan in 2020, with a CAGR of 19.5% from 2015 to 2020.

Along with the development of the IoT, the MCU market is experiencing a price and volume increase. In the future, IoT will realize end-to-end human-machine interaction, almost every device needs one or even more MCU at each end. More data and higher computing requirements will drive devices to upgrade to 32-bit high-end MCU.

Device networking method

The key to device networking is networking technology, which includes LoRa (long-range radio), Zigbee (short-range low-speed), WiFi, NB-IoT (cellular network), Bluetooth, and requires a responsive networking module to remotely control devices.

The number of IoT connections in China will reach 3.5 billion by 2020, with a CAGR of 34% from 2017 to 2020. The main networking methods are WiFi and Bluetooth, with WiFi and Bluetooth networking technology accounting for 67.3% of the total in 2020, and cellular networking accounting for 8.75% in 2020, up from 3% in 2017. RF manufacturers have launched communication protocols + MCU solutions.

(2) Smart Home

The trend of home appliance intelligence: mechanical button interaction to touch voice interaction, digital tube display to LCD display, single frequency to variable frequency, etc. The demand for computing power and anti-interference ability will increase, and the demand will shift to more advanced MCU.

In 2020, the total number of smart home products shipped in China will reach 280 million units, and by 2025 the total number of units shipped will grow to 810 million units, with a compound annual growth rate of 23.7%.

Home video and telecommunications equipment (TV sets, set-top boxes) and intelligent security products (cameras, door locks) accounted for the highest proportion, reaching 39.2% and 19.6% respectively; smart white goods (refrigerators, air conditioners, washing machines) accounted for nearly 20% of the total, reaching 17.1%.

Residential intelligence

Intelligent housing uses integrated wiring technology, network communication technology, security technology, automatic control technology, audio and video technology, etc. to integrate home life-related facilities, and through the MCU in the host to carry out comprehensive control, and build an efficient management system of residential facilities and family schedule affairs.

The real estate market is changing from incremental to stock, and real estate developers are actively seeking transformation paths.

(3) Smart Wear

In 2016, Apple released the first generation of Air Pods, creating the era of true wireless headphones (TWS), and the iPhone 12 series eliminated the standard headphones, triggering a surge in sales of TWS headphones again.

The TWS industry chain mainly includes ODM manufacturers, wireless headsets, and charging box component manufacturers, including main control chip. storage chip. FPC, voice acceleration sensor, MEMS, overcurrent protection IC, battery, etc.

TWS headset market space and competitive landscape

The TWS headset market will have the same growth trend as smartphones a decade ago, with a CAGR of 80% for the smartphone market from 2009-2012 and an expected CAGR of 80% for the TWS market from 2019-2022.

After Air Pods detonated the market, cell phone manufacturers such as Huawei, OPPO, Vivo, Xiaomi and traditional audio manufacturers Sony, BOSE, 1MORE, Wanderer have followed up with related products, Apple market share is still the first, other brands of headphones are also accelerating to seize, making Apple's market share decreases year by year.

(4) Automotive electronics

Automotive electronics applications already occupy more than 1/3 of the MCU market, and the demand for MCU is growing rapidly because of the increasingly high requirements for safety and environmental protection in the process of intelligent cars. Sales of automotive MCUs will approach $6.5 billion by 2020 and reach $8.1 billion by 2023. MCU accounts for 23% of the total semiconductor value of traditional fuel vehicles and 11% of the total semiconductor value of pure electric vehicles, and the semiconductor value of traditional fuel vehicles is US$338 and new energy vehicles are US$704 in 2018.

(5) Industrial Control

MCU is the core component to realize industrial automation, such as stepper motor, robot arm, instrumentation, industrial motor, etc.. In order to achieve the complex motion required by industrial robots, the position, direction, speed, and torque of the motor need to be controlled with high precision, and the MCU can perform the complex, high-speed calculations required for motor control.

The global industrial control market is expected to reach $231 billion in 2019 and $260 billion by 2023, growing at a compound annual growth rate of about 3%. The market size is expected to reach 260 billion yuan in 2021.

IV. List of top 10 MCU (microcontroller) manufacturers

Company | Market value (100 million/RMB) | P/E ratio | Revenue in 2020 (100 million/RMB) | Revenue in 2019 (100 million/RMB) |

Samsung Electronics | 29,012 | 21 | 14,201 | 13,898 |

Texas Instruments | 11,025 | 24 | 944 | 1,003 |

NXP | 3,853 | 38 | 562 | 619 |

Infineon | 3,754 | 69 | 685 | 623 |

Microchip | 3,072 | 75 | 374 | 360 |

STMicroelectronics | 2,811 | 24 | 667 | 667 |

Renesas | 1,541 | 21 | 469 | 437 |

Unigroup | 1,251 | 64 | 33 | 34 |

GigaDevice | 1,161 | 53 | 45 | 32 |

Toshiba | 1,113 | 13 | 2,222 | 2,248 |

1. What reduces the frequency and specifications of the CPU?

Microcontrollers

2. What can the upstream of the MCU industry chain be divided into?

Raw material suppliers and foundries

Getting Started with Arduino: What is Arduino and How to Use Arduino BoardsUTMEL28 September 20236145

Getting Started with Arduino: What is Arduino and How to Use Arduino BoardsUTMEL28 September 20236145Arduino is an open-source electronics platform that includes software and programmable circuit boards, allowing beginners to build electronic projects by writing simple code. The article provides an overview of Arduino, including different board types, basic components, how to use the boards, and project ideas like an automated plant watering system.

Read More Arduino vs. Raspberry Pi: A Detailed ComparisonUTMEL24 April 20254849

Arduino vs. Raspberry Pi: A Detailed ComparisonUTMEL24 April 20254849Hello everyone, welcome to the new post today.This guide is going to talk in detail about Arduino vs. Raspberry Pi to clarify their differences and help you pick the right board based on your needs.

Read More Electronic Components in the Smart Home SystemUTMEL24 April 20252428

Electronic Components in the Smart Home SystemUTMEL24 April 20252428Electronic parts are the heart of every smart home system. These parts help devices talk, do tasks, and save energy. For instance, sensors notice motion or temperature changes. Microcontrollers use this data to do things like dim lights or turn on alarms.

Read More Software Tools for NXP Microcontroller DevelopmentUTMEL06 June 20251147

Software Tools for NXP Microcontroller DevelopmentUTMEL06 June 20251147Discover how NXP microcontroller tools like MCUXpresso IDE, SDK, and Config Tools streamline coding, debugging, and hardware setup for embedded systems.

Read More VFD Driving Guide: What to Do When Your MCU Runs Out of Pins?UTMEL22 July 2025877

VFD Driving Guide: What to Do When Your MCU Runs Out of Pins?UTMEL22 July 2025877This comprehensive guide addresses a common challenge faced by electronics enthusiasts: driving Vacuum Fluorescent Displays (VFDs) when microcontrollers have insufficient pins. Sparked by a Reddit user's question about controlling a VFD with more segments than available MCU pins, the article explores the elegant solution of multiplexing technology.

Read More

Subscribe to Utmel !

![SDCFJ-512-388-J]() SDCFJ-512-388-J

SDCFJ-512-388-JWestern Digital

![SDSDQAF3-016G-I]() SDSDQAF3-016G-I

SDSDQAF3-016G-IWestern Digital

![SDSDQAF3-032G-I]() SDSDQAF3-032G-I

SDSDQAF3-032G-IWestern Digital

![JustBoom Player OS SD Card | PIS-0565]()

![COM-13833]() COM-13833

COM-13833SparkFun

![SDSDQAB-008G]() SDSDQAB-008G

SDSDQAB-008GWestern Digital

![SQR-UD4N8G2K4HNHAC]() SQR-UD4N8G2K4HNHAC

SQR-UD4N8G2K4HNHACAdvantech

![96SD4-8G3200NN-MI]() 96SD4-8G3200NN-MI

96SD4-8G3200NN-MIAdvantech

![SQR-SD4N32G2K6SEME]() SQR-SD4N32G2K6SEME

SQR-SD4N32G2K6SEMEAdvantech

![96D4-8G3200NN-MI]() 96D4-8G3200NN-MI

96D4-8G3200NN-MIAdvantech