Japanese Companies Increase Investment in Power Semiconductors

Tokyo Electron: Japan’s Biggest Semiconductor Equipment Maker

Japanese domestic motor manufacturers have intensified the production of "power semiconductors" that control electricity. This is because in the global atmosphere of decarbonization, power semiconductors are an indispensable component for energy saving, and the market is expected to expand rapidly mainly for pure electric vehicles (EV). The current situation of this component is that Japanese companies are doing well, but it is foreseen that competition for investment will become fierce, and whether they can continue to maintain their presence will be tested.

Toshiba, which has split into two companies and is striving to reorganize its operations, will spend about 200 billion yen (10.8 billion yuan) to expand its plant in Nomi City, Ishikawa Prefecture, as the main business of its semiconductor division "Equipment Company" after the split, and aims to start production in 2024. The use of 300 mm diameter wafers of large disc material to produce multiple products at once to reduce costs.

Mitsubishi Electric will invest about 130 billion yen by the end of fiscal 2025 to increase production capacity by about one time compared to fiscal 2020, introducing production using 300 mm diameter wafer materials at its plant in Fukuyama City, Hiroshima Prefecture. Fuji Electric will begin mass production of high-performance next-generation products at its factory in Goshogawara City, Aomori Prefecture, in fiscal 2024.

According to the British research firm Omdia, in 2020 power semiconductor sales of Japanese companies ranked high, Mitsubishi Electric ranked third in the world, Fuji Electric fifth, Toshiba sixth, Renesas Electronics seventh. But the first place in Germany Infineon Technologies 2021 to take the lead in the use of large disc materials for production, Chinese companies are also growing in strength under the strong support of the government.

Akira Minagawa, senior consulting director of Media, believes that "if we compete with Europe and China under the same conditions, we will have no chance to win" and is worried that we will be in competition for investment, suggesting that "we should promote areas in which Japan excels," such as developing products that combine semiconductors and engines. The proposal says that "we should promote the areas in which Japan excels," such as developing products that combine semiconductors and engines, improving performance, and miniaturization.

In addition, Russia and Ukraine are important sources of palladium and neon gas used in semiconductor manufacturing, and Russian aggression is a risk factor.

Japan Makes Efforts to Manufacture Silicon Carbide Power Semiconductors

Aiming at the expansion of demand for pure electric vehicles (EV), Japanese companies have begun to increase the production of next-generation semiconductors with higher energy efficiency. The materials used are not traditional silicon but new materials, and Toshiba will expand its production scale to 10 times that of fiscal 2020 by fiscal 2025, and Rohm (ROHM) will invest 50 billion yen to strengthen production. In order to stabilize and secure raw materials, each company will also build a company including material manufacturers through mergers and acquisitions (M&A), etc.

Each company will increase the production of "power semiconductors" that supply and control electricity. Instead of using silicon, which used to be the mainstay of semiconductor wafers, "silicon carbide (SiC)" is used. Silicon carbide has a strong bonding force and is 10 times more resistant to voltage than silicon. Compared to silicon, silicon carbide can manage power efficiently even when high voltage is applied.

Power semiconductors using silicon carbide can reduce power consumption by 5 to 8% when used in inverters for pure electric vehicles. This can extend the range and reduce the battery capacity. It is also expected to spread in areas that need to support high voltage, such as photovoltaic power generation equipment and industrial equipment.

According to Japanese research firm Fuji Economy (Chuo-ku, Tokyo), global sales of pure electric vehicles will surpass those of hybrid vehicles (HV) in 2022 and will reach 24.18 million units by 2035, 11 times the number in 2020. Tesla in the United States, the leader in pure electric vehicles, and some Chinese companies are already using silicon carbide power semiconductors.

If silicon carbide power semiconductors are adopted by cars with a large number of units per vehicle and a large scale industry, the demand for them is likely to expand rapidly. With the aim of officially launching mass production, companies engaged in power semiconductors are already building up their production systems.

Rohm is investing approximately 50 billion yen to expand its production capacity of silicon carbide power semiconductors by more than five times by 2025. The company has already built a new plant for manufacturing-related products at its plant in Chikugo City, Fukuoka Prefecture, and plans to open it in 2022. Geely Automobile, a major Chinese automaker, has decided to use Roma's products for its pure electric vehicles, aiming to increase its global share, which now stands at nearly 20%, to 30% as soon as possible.

Toshiba's semiconductor business subsidiary Toshiba Devices&Storage plans to increase production of silicon carbide power semiconductors at its Himeji Semiconductor Plant in Taiko-Cho, Hyogo Prefecture, Japan, to more than three times the capacity of fiscal 2020 in fiscal 2023, and to 10 times as soon as possible. The company aims to obtain a global share of more than 10% by FY2030.

Toshiba Devices&Storage previously produced mainly railroad equipment, with annual sales of more than one billion yen. It is said that if all products for railroad systems are made of silicon carbide, the size of the equipment can be reduced by about 38% and the power consumption can be reduced by about 20% compared to the original products that also use silicon. In the future, it will be expanded to include products for servers and industrial power supplies and will be launched for automotive products after 2024.

Fuji Electric is also considering advancing the launch of silicon carbide products by six months to a year from the original plan (2025).

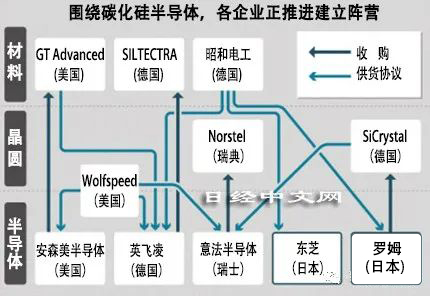

The issue facing the increase in production is the stable procurement of materials. Silicon carbide products require high processing technology, so cooperation with material manufacturers is indispensable. The movement of semiconductor companies to sign supply contracts with upstream raw material companies has also become active.

Showa Denko, a major Japanese raw materials company, announced in September that it had signed a two-and-a-half-year long-term supply contract with Toshiba Devices&Storage for silicon carbide wafers. Showa Denko also signed a priority supply contract with Germany's Infineon Technology (Infineon), the world's largest company accounting for more than 20% of the overall share of power semiconductors, in May, and orders are increasing.

There is also a trend among semiconductor companies to promote "vertical integration" with material manufacturers through mergers and acquisitions (M&A). ON Semiconductor, which has the world's No. 2 share of power semiconductors, announced in August that it would acquire a U.S. company engaged in the production of silicon carbide for approximately 46 billion yen. Rohm also acquired SiCrystal, a German manufacturer of silicon carbide wafers, in 2009, and further progress is expected in the construction of the camp.

In the semiconductor field, Japanese domestic companies are said to be in the doldrums. Against this backdrop, power semiconductors are an area where Japanese companies are still showing a presence. Mitsubishi Electric, Toshiba, Fuji Electric, Renesas Electronics, and other Japanese companies together have more than two percent of the global share. Whether Japanese companies can also attract strong customers in the field of next-generation products "silicon carbide power semiconductors" will be the key to expanding their market share in the future.

According to British research firm Media, the market size of silicon carbide power semiconductors, which was about $1.2 billion in 2020, will reach about $4 billion by 2025, expanding more than three times.

Related News

1、MediaTek, Qualcomm announce joining Russia sanctions

2、Automotive chips rose across the board!

3、Apple M1 Ultra -- The Technology Behind the Chip Interconnection

4、Foxconn Announces Investment of $9 Billion to Build A Chip Factory in Saudi Arabia

5、Apple Will Help TSMC to Be in The Leading Position in The Next Era

UTMEL 2024 Annual gala: Igniting Passion, Renewing BrillianceUTMEL18 January 20243087

UTMEL 2024 Annual gala: Igniting Passion, Renewing BrillianceUTMEL18 January 20243087As the year comes to an end and the warm sun rises, Utmel Electronics celebrates its 6th anniversary.

Read More Electronic Components Distributor Utmel to Showcase at 2024 IPC APEX EXPOUTMEL10 April 20243934

Electronic Components Distributor Utmel to Showcase at 2024 IPC APEX EXPOUTMEL10 April 20243934Utmel, a leading electronic components distributor, is set to make its appearance at the 2024 IPC APEX EXPO.

Read More Electronic components distributor UTMEL to Showcase at electronica ChinaUTMEL07 June 20242550

Electronic components distributor UTMEL to Showcase at electronica ChinaUTMEL07 June 20242550The three-day 2024 Electronica China will be held at the Shanghai New International Expo Center from July 8th to 10th, 2024.

Read More Electronic components distributor UTMEL Stands Out at electronica china 2024UTMEL09 July 20242786

Electronic components distributor UTMEL Stands Out at electronica china 2024UTMEL09 July 20242786From July 8th to 10th, the three-day electronica china 2024 kicked off grandly at the Shanghai New International Expo Center.

Read More A Combo for Innovation: Open Source and CrowdfundingUTMEL15 November 20193665

A Combo for Innovation: Open Source and CrowdfundingUTMEL15 November 20193665Open source is already known as a force multiplier, a factor that makes a company's staff, financing, and resources more effective. However, in the last few years, open source has started pairing with another force multiplier—crowdfunding. Now the results of this combination are starting to emerge: the creation of small, innovative companies run by design engineers turned entrepreneurs. Although the results are just starting to appear, they include a fresh burst of product innovation and further expansion of open source into business.

Read More

Subscribe to Utmel !

![HWS50A-12/HDA]() HWS50A-12/HDA

HWS50A-12/HDATDK-Lambda Americas Inc

![VS100E-12]() VS100E-12

VS100E-12TDK-Lambda Americas Inc

![PVG3K200C01R00]() PVG3K200C01R00

PVG3K200C01R00Bourns Inc.

![PVG3K503C01R00]() PVG3K503C01R00

PVG3K503C01R00Bourns Inc.

![PVG3K105C01R00]() PVG3K105C01R00

PVG3K105C01R00Bourns Inc.

![PVG3K501C01R00]() PVG3K501C01R00

PVG3K501C01R00Bourns Inc.

![PVG3K202C01R00]() PVG3K202C01R00

PVG3K202C01R00Bourns Inc.

![PVG3K504C01R00]() PVG3K504C01R00

PVG3K504C01R00Bourns Inc.

![PVG3K201C01R00]() PVG3K201C01R00

PVG3K201C01R00Bourns Inc.

![ZWS50B-12/CO2]() ZWS50B-12/CO2

ZWS50B-12/CO2TDK-Lambda Americas Inc