ICinsights:MCUs Will Continue to Rise in Price

Volatility in wholesale prices will not impact energy prices: EMA

According to IC Insights, microcontroller sales are picking up fast with a strong economic recovery in 2021, when the MCU market climbed 23% to a record $19.6 billion after falling 2% in 2020 amid the Covid-19 virus crisis. IC Insights forecasts that worldwide microcontroller sales will grow 10% in 2022 to an all-time high of $21.5 billion (Figure 1), with automotive MCUs growing faster than most other end-use categories this year.

In 2021, a strong rebound in the average selling price of microcontrollers will push their ASP up 10% to $0.64, which is the average price before the Covid-19 pandemic in 2019. 2021, MCU ASP growth is the highest annual growth rate for MCUs in the last 25 years. This is primarily due to the tight supply of microcontrollers in the rebounding economy in 2021. The MCU market has been facing significant price declines for two decades, but the rate of ASP decline has slowed over the past five years, and IC Insights now expects MCU ASPs to rise at a compound annual growth rate (CAGR) of 3.5% between 2021 and 2026.

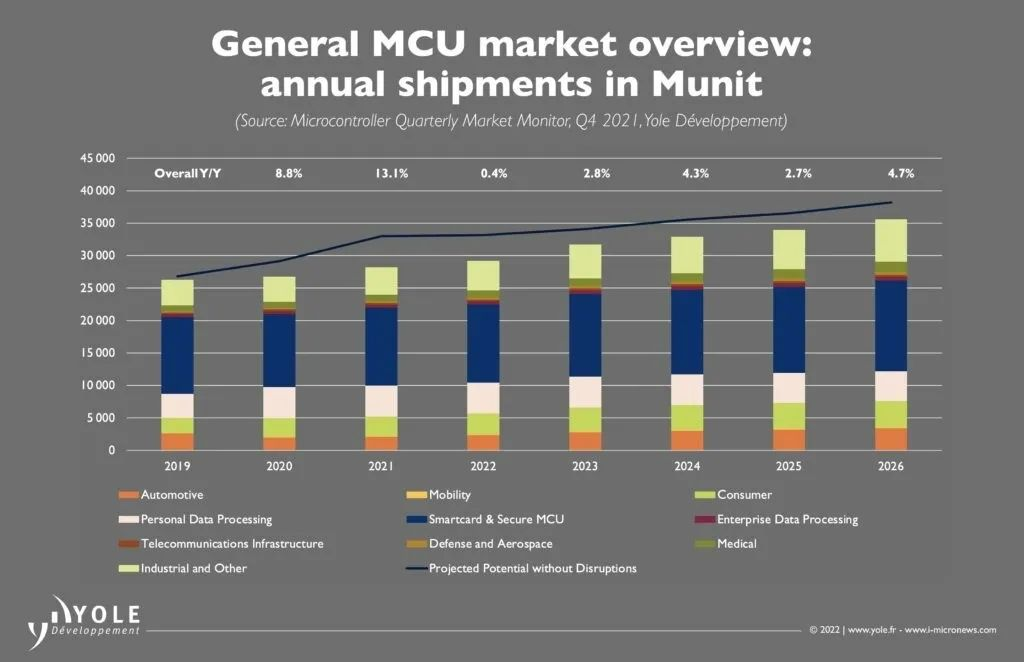

Production and supply chain bottlenecks are preventing total MCU shipments from growing to 12 percent in 2021, bringing global microcontroller deliveries to an all-time high of 30.9 billion last year, and IC Insights forecasts total MCU shipments to grow at a CAGR of 3.0 percent over the next five years, reaching 35.8 billion by 2026.

Total MCU sales are expected to grow at a CAGR of 6.7% from 2021 to 2026, reaching $27.2 billion in the final year of the forecast. Sales of 32-bit MCUs are expected to grow at a CAGR of 9.4% over the next five years to reach $20 billion by 2026. Meanwhile, sales of 4/8-bit MCUs are not expected to grow over the next five years, remaining at approximately $2.4 billion by 2026. Revenue from 16-bit microcontrollers is expected to grow at a CAGR of 1.6% over the 2021-2026 period to $4.7 billion at the end of the forecast.

A downturn in the automotive industry and a weak global economy in 2019 led to a 9% decline in MCU shipments that year, the worst unit decline since the 2009 semiconductor downturn (-11%). Surprisingly, however, MCU unit shipments rebounded in 2020, growing 8 percent despite the coronavirus crisis and extensive lockdown measures to slow the pandemic. MCU demand in the 2020 virus crisis was driven primarily by sales of home entertainment systems and electronics purchased by quarantined consumers, including large-screen TVs, IoT-connected products, and more Sensors are being packed into smartphones.

About 46 percent of microcontroller sales come from MCUs in "general purpose" embedded applications, including smartphones, computers and peripherals, industrial use, and consumer products, while a little more than 40 percent comes from automotive systems and 14 percent from the smart card market for banking, credit, and debit card purchases, transit fares, ID cards, and other uses. Over the next five years, automotive MCU sales are expected to grow at a compound annual growth rate of 7.7 percent, while general-purpose MCU revenue is expected to grow 7.3 percent and the smart card market is expected to grow at a 1.4 percent annual growth rate through 2026.

MCU Manufacturers and Brewing Price Increases?

According to Taiwan's Business Times, a legal entity pointed out that the current 32-bit MCU demand is robust, supply is quite tight, and the unit price of the product is maintained at a high level. The supply chain pointed out that the international IDM maker will be a large amount of 32-bit MCU capacity to supply automotive, industrial control, and other high-end customers, production capacity is expected to be tight for a full year; Infineon, a major European IDM manufacturer (Infineon) issued a "recent market and cost dynamics" notice to distributors, brewing a comprehensive price increase with clear intentions, the corporation expects that once its price increase is successful, the possibility of high follow-through in the same industry, such as Taiwan's New Tang and Holtek, etc. are also jumping on the bandwagon.

Yole: MCU Prices Will Continue to Rise Over the Next Five Years

As Yole predicted, MCU prices rose in 2021 to an extent that even exceeded their expectations, which led to a very strong rebound in MCU industry revenues at the end of 2021, despite supply chain disruptions that led to an inability to meet demand in multiple markets, but MCU prices rose sharply in 2021 and will rise in the next five years. In other words, this artificially high price is unlikely to fall significantly until 2026.

According to Yole's forecast, there is a risk of overbuilding fabs to depress prices through 2024 and beyond, but this is unlikely to directly impact the microcontroller market because new fabs are not targeting the mature manufacturing technologies needed for traditional MCUs, but rather the advanced process markets needed for cutting-edge MPUs, GPUs and gas pedals. It is more likely that integrated design manufacturers and foundry services will be incentivized to keep prices high for the time being in order to restore some of the investment in refurbishment, new fabs, and other measures to provide new capacity for high-demand, cutting-edge technologies.

Bringing prices down significantly will require one or more manufacturers to develop strategies to increase share by undercutting the competition. This may be a short-term win for some smaller suppliers to gain share, but ultimately, maintaining higher average selling prices and reinvesting will pay more long-term dividends, so this is less likely than a gradual decline in average selling prices, which is likely to benefit most suppliers regardless of market share.

Although manufacturers have raised prices to curb the demand that keeps them at full capacity, demand for semiconductors, including MCUs, appears to continue to outpace supply as the supply chain remains disrupted and lead times to fulfill orders continue to increase. In some markets, current estimates are already six months or longer.

Current measures supported by manufacturers and their respective governments are expected to improve supply as early as late 2023 and early 2024 as new fabs begin to relieve pressure, but this fix is unlikely to allow shipments to correct to pre-disruption levels as many consumers and industries simply opt for alternative solutions (such as used cars) or lose purchasing power altogether.

ICInsights: Automotive Microcontroller Sales to Grow 23% in 2021

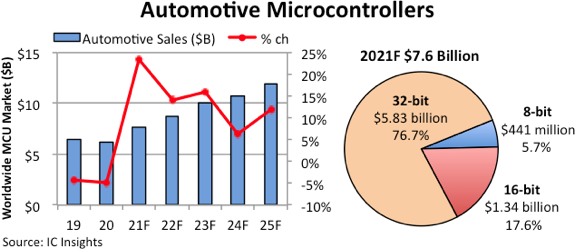

The automotive microcontroller market is huge, accounting for approximately 40% of total microcontroller (MCU) sales over the past decade. The past few years have been uneven. global automotive MCU sales grew 12% in 2017; growth slowed to just 1% in 2018.

Continued shortages of microcontrollers due to the impact of the new crown epidemic forced automakers to temporarily shut down assembly lines this year, but automotive microcontroller sales are expected to surge 23 percent to $7.6 billion and a new record in 2021 as the economy recovers. Strong growth of 14 percent and 16 percent is expected in 2022 and 2023, respectively.

More than 3/4 of automotive MCU sales are 32-bit microcontrollers, which are expected to reach approximately $5.8 billion this year. 16-bit MCU revenue is expected to reach $1.3 billion, and 8-bit MCU revenue is expected to reach $441 million in 2021. 32-bit MCUs' average selling price helped push sales higher this year, in part due to tight market supply. The mid-year forecast shows that ASPs for all 32-bit MCUs will grow at a compound annual growth rate (CAGR) of -4.4% from 2015 to 2020. However, it grows 13% to $0.72 in 2021.

Automotive infotainment is expected to account for 10% of automotive MCU sales in 2021, or about $780 million, including entertainment and information systems for retrieving digital maps, identifying locations, and transmitting access to data from the Internet and satellites; microcontrollers for the rest of the vehicle are expected to account for 90% of this year's revenue, or $6.8 billion, including engine control, powertrain, brakes, steering power windows, battery management, etc. Sales of infotainment MCUs in 2021 will be 59% higher than in 2020 ($495 million); while other revenues from automotive MCUs are expected to rise 20% from last year ($5.7 billion).

Related News

1、MediaTek, Qualcomm announce joining Russia sanctions

2、Automotive chips rose across the board!

3、Apple M1 Ultra -- The Technology Behind the Chip Interconnection

4、Foxconn Announces Investment of $9 Billion to Build A Chip Factory in Saudi Arabia

5、Japanese Companies Increase Investment in Power Semiconductors

UTMEL 2024 Annual gala: Igniting Passion, Renewing BrillianceUTMEL18 January 20244503

UTMEL 2024 Annual gala: Igniting Passion, Renewing BrillianceUTMEL18 January 20244503As the year comes to an end and the warm sun rises, Utmel Electronics celebrates its 6th anniversary.

Read More Electronic Components Distributor Utmel to Showcase at 2024 IPC APEX EXPOUTMEL10 April 20245463

Electronic Components Distributor Utmel to Showcase at 2024 IPC APEX EXPOUTMEL10 April 20245463Utmel, a leading electronic components distributor, is set to make its appearance at the 2024 IPC APEX EXPO.

Read More Electronic components distributor UTMEL to Showcase at electronica ChinaUTMEL07 June 20244064

Electronic components distributor UTMEL to Showcase at electronica ChinaUTMEL07 June 20244064The three-day 2024 Electronica China will be held at the Shanghai New International Expo Center from July 8th to 10th, 2024.

Read More Electronic components distributor UTMEL Stands Out at electronica china 2024UTMEL09 July 20244434

Electronic components distributor UTMEL Stands Out at electronica china 2024UTMEL09 July 20244434From July 8th to 10th, the three-day electronica china 2024 kicked off grandly at the Shanghai New International Expo Center.

Read More A Combo for Innovation: Open Source and CrowdfundingUTMEL15 November 20195028

A Combo for Innovation: Open Source and CrowdfundingUTMEL15 November 20195028Open source is already known as a force multiplier, a factor that makes a company's staff, financing, and resources more effective. However, in the last few years, open source has started pairing with another force multiplier—crowdfunding. Now the results of this combination are starting to emerge: the creation of small, innovative companies run by design engineers turned entrepreneurs. Although the results are just starting to appear, they include a fresh burst of product innovation and further expansion of open source into business.

Read More

Subscribe to Utmel !

![AMEOF5-9SJZ-120]() AMEOF5-9SJZ-120

AMEOF5-9SJZ-120aimtec

![AMES50-24SNZ]() AMES50-24SNZ

AMES50-24SNZaimtec

![AME25-12S277PEVZ]() AME25-12S277PEVZ

AME25-12S277PEVZaimtec

![AME15-9S277VZ-60]() AME15-9S277VZ-60

AME15-9S277VZ-60aimtec

![AMES25-3S277NZ-P]() AMES25-3S277NZ-P

AMES25-3S277NZ-Paimtec

![AMES35-5SNZ-Q]() AMES35-5SNZ-Q

AMES35-5SNZ-Qaimtec

![AME25-48S277PEVZ-B]() AME25-48S277PEVZ-B

AME25-48S277PEVZ-Baimtec

![AME15-5SMAZ-E-T]() AME15-5SMAZ-E-T

AME15-5SMAZ-E-Taimtec

![AMEL20-3S277HAVZ-ST]() AMEL20-3S277HAVZ-ST

AMEL20-3S277HAVZ-STaimtec

![AME15-12S277PEVZ]() AME15-12S277PEVZ

AME15-12S277PEVZaimtec