Japan's Three-Stage Strategy to Revive the Semiconductor Industry

Japan invests 10 trillion to allow TSMC to develop the domestic semiconductor industry.

Continuing chip shortages and the high risk of disruptions in the semiconductor supply chain remain major challenges for governments around the world, and Japan is under tremendous pressure to find solutions to revitalize the semiconductor industry.

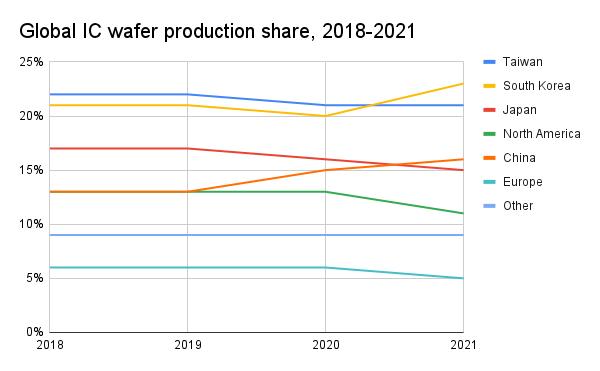

In recent years, the global market share of Japanese semiconductor companies has been declining, from 50.3% in 1988 to less than 10%. To develop an effective industry revitalization strategy, the Japanese government and domestic semiconductor companies are now reflecting on why Japan's semiconductor industry has been losing ground to foreign competitors in the global market.

Five causes of Japan's "Lost Decades"

According to Nikkei and Mynavi, Japan's Ministry of Economy, Trade, and Industry (METI) mentioned a potential strategy for revitalizing the country's semiconductor industry in its "Strategy for Semiconductor and Digital Industries" released last June.

The ministry has narrowed the causes of Japan's "Lost Decades" down to five.

1. To minimize trade conflicts with the United States, Japan signed a semiconductor agreement with Washington in 1986. The agreement included several restrictions on Japan's semiconductor industry, which led to Japan losing its dominant position in the global market. As Japan's market share in semiconductors declined, Intel's share rose to become the industry's highest revenue earner.

2. Logic semiconductor manufacturing and design have shifted from vertical division of labor to horizontal integration, making it difficult for Japanese chipmakers to keep up with the trend. It was not until 2010 that Renesas completed the integration of the MCU and LSI semiconductor businesses of Hitachi, Mitsubishi Electric, and NEC.

3. Japan's digital market underperformed and failed to become a breeding ground for the semiconductor industry. Due to limited investment in digitalization by Japanese companies, semiconductor companies lacked customers. the development of IC design lagged behind, forcing companies to import advanced semiconductors from overseas.

4. The pursuit of self-sufficiency after the 1990s hindered Japan's linkage to the global innovation ecosystem. Although the country started a public-private semiconductor R&D collaboration project in 2001, the project's results have been limited.

5. Japanese companies have invested less in semiconductors than South Korea, Taiwan, and China. Since the Japanese economy fell into recession in the 1990s, companies have been reluctant to invest in the country's semiconductor industry.

Source: IC Insights and Knometa Research; Compiled by DIGITIMES

Japan's Three-Phase Strategy to Revive Semiconductor Industry

In response to the U.S.-China trade war, governments around the world have begun to promote the localization of semiconductors. Japan's Ministry of Economy, Trade, and Industry has also proposed a three-phase strategy to revitalize the country's semiconductor industry over the next 10 years.

Phase I: Strengthen semiconductor production infrastructure for IoT devices

For economic security reasons, Japan must ensure a stable supply of advanced semiconductors, such as logic ICs and memory chips. To do so, the government needs to attract foreign chipmakers to establish factories in Japan and promote domestic semiconductor production through incentives and subsidies.

METI no longer insists that Japan produce its own semiconductors. In fact, the ministry plans to attract foreign chipmakers to set up advanced wafer fabs in Japan even before the chip shortage worsens in 2019.

Japanese media reported that the Japanese government had considered attracting TSMC, Intel, and Samsung Electronics to Japan. However, Samsung is no longer a candidate after Japan imposed stricter controls on exports of semiconductor materials to South Korea in 2019. Ultimately, TSMC agreed to build a wafer fab in Kumamoto Prefecture, with investment from Sony and Denso.

Phase II: Develop next-generation semiconductor technologies with the US

Japan's National Institute of Advanced Industrial Science and Technology (AIST) has launched an R&D alliance to develop 2nm and below manufacturing processes. Intel and IBM are investors in the consortium, and the results should be available around 2025. future semiconductor R&D projects at METI will also involve collaboration between Japanese and foreign companies.

Phase III: Plan for larger-scale international collaborations, enhance future semiconductor technologies

Japan will turn to photovoltaic fusion technologies with greater precision and computational efficiency. These technologies could transform the semiconductor industry after 2030 and lead to a new wave of national R&D projects.

TSMC's JASM shifting to 16/12nm

METI's three-stage semiconductor industry revival strategy has yielded some results. TSMC's Kumamoto-based subsidiary JASM originally planned to bring 28/22nm processes to Japan. However, following Sony and Denso's investment in JASM, the company announced in February 2022 that it will now instead produce 16/12nm processes in the country.

Akira Amari, a member of the LDP who leads its semiconductor policy group, noted that the Chinese and Taiwanese governments will strive to keep their most advanced semiconductor technology in Taiwan. Therefore, Japan must form an international alliance to develop advanced processes at 2nm and below, he said.

Amari said he hopes the Japanese government and companies will invest a combined 7-10 trillion yen ($6.05-86.5 billion) over the next 10 years to help the country increase its semiconductor production capacity and related technologies. He suggested that the country should revitalize its semiconductor industry through decade-long projects that are in line with the revitalization strategy envisioned by METI.

Related News

1、MediaTek, Qualcomm announce joining Russia sanctions

2、Automotive chips rose across the board!

3、Apple M1 Ultra -- The Technology Behind the Chip Interconnection

4、Foxconn Announces Investment of $9 Billion to Build A Chip Factory in Saudi Arabia

5、Japanese Companies Increase Investment in Power Semiconductors

UTMEL 2024 Annual gala: Igniting Passion, Renewing BrillianceUTMEL18 January 20244503

UTMEL 2024 Annual gala: Igniting Passion, Renewing BrillianceUTMEL18 January 20244503As the year comes to an end and the warm sun rises, Utmel Electronics celebrates its 6th anniversary.

Read More Electronic Components Distributor Utmel to Showcase at 2024 IPC APEX EXPOUTMEL10 April 20245463

Electronic Components Distributor Utmel to Showcase at 2024 IPC APEX EXPOUTMEL10 April 20245463Utmel, a leading electronic components distributor, is set to make its appearance at the 2024 IPC APEX EXPO.

Read More Electronic components distributor UTMEL to Showcase at electronica ChinaUTMEL07 June 20244064

Electronic components distributor UTMEL to Showcase at electronica ChinaUTMEL07 June 20244064The three-day 2024 Electronica China will be held at the Shanghai New International Expo Center from July 8th to 10th, 2024.

Read More Electronic components distributor UTMEL Stands Out at electronica china 2024UTMEL09 July 20244434

Electronic components distributor UTMEL Stands Out at electronica china 2024UTMEL09 July 20244434From July 8th to 10th, the three-day electronica china 2024 kicked off grandly at the Shanghai New International Expo Center.

Read More A Combo for Innovation: Open Source and CrowdfundingUTMEL15 November 20195028

A Combo for Innovation: Open Source and CrowdfundingUTMEL15 November 20195028Open source is already known as a force multiplier, a factor that makes a company's staff, financing, and resources more effective. However, in the last few years, open source has started pairing with another force multiplier—crowdfunding. Now the results of this combination are starting to emerge: the creation of small, innovative companies run by design engineers turned entrepreneurs. Although the results are just starting to appear, they include a fresh burst of product innovation and further expansion of open source into business.

Read More

Subscribe to Utmel !

![AMEOF5-9SJZ-120]() AMEOF5-9SJZ-120

AMEOF5-9SJZ-120aimtec

![AMES50-24SNZ]() AMES50-24SNZ

AMES50-24SNZaimtec

![AME25-12S277PEVZ]() AME25-12S277PEVZ

AME25-12S277PEVZaimtec

![AME15-9S277VZ-60]() AME15-9S277VZ-60

AME15-9S277VZ-60aimtec

![AMES25-3S277NZ-P]() AMES25-3S277NZ-P

AMES25-3S277NZ-Paimtec

![AMES35-5SNZ-Q]() AMES35-5SNZ-Q

AMES35-5SNZ-Qaimtec

![AME25-48S277PEVZ-B]() AME25-48S277PEVZ-B

AME25-48S277PEVZ-Baimtec

![AME15-5SMAZ-E-T]() AME15-5SMAZ-E-T

AME15-5SMAZ-E-Taimtec

![AMEL20-3S277HAVZ-ST]() AMEL20-3S277HAVZ-ST

AMEL20-3S277HAVZ-STaimtec

![AME15-12S277PEVZ]() AME15-12S277PEVZ

AME15-12S277PEVZaimtec